Exclusive

Graph of the Week: Higher credit costs to hit Hong Kong in 2012

Blame it on lower global economic activity, weakening domestic property markets, and higher inflation.

Graph of the Week: Higher credit costs to hit Hong Kong in 2012

Blame it on lower global economic activity, weakening domestic property markets, and higher inflation.

Worries over funding costs in Hong Kong loom in 2012

Given the challenges in credit growth and deposit, Fitch warns of some increase in funding costs.

FATCA set to be a burden to Asian banks

As the US pushes for stricter regulations to avoid tax evasion, Asian banks are forced to follow implementation and remediation requirements by 2015 - find out what analysts from Deloitte, PwC, KPMG, and Ernst & Young have to say.

Will OTC derivatives clearing in Asia mirror the US and EU model?

Standard Chartered’s Giles Elliot says it will surely have a big impact in the market, though not all players can afford the capital charges for extensive memberships in different markets.

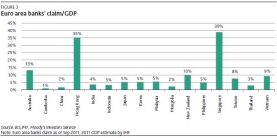

Graph of the Week: AsiaPac banks’ exposure to the EU crisis

Singapore and Hong Kong will be the hardest hit should euro area banks retreat.

Regulation and tax pressures to hit the securities industry in 2012

HSBC and Standard Chartered concur that banks in Asia will have to brace for a depth of regulatory change and evolution of tax regimes this year.

ATM makers hope to squeeze cash out of system

New software even plans out more efficient truck delivery routes.

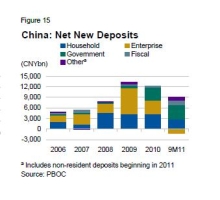

Graph of the Week: China's dwindling deposits

China’s deposits are slowing down which may force banks to raise more money.

Deposit woes continue to haunt China’s banking sector

In a recent teleconference, Fitch analyst Charlene Chu warned earnings growth is not strong enough and banks will be forced to raise equity.

Bankers probe for more efficient custody & clearing platforms

Find out what HSBC’s Ian Banks and Standard Chartered’s Giles Elliot have to say about the challenge of having a system that embeds sufficient functionality in multi market implementations.

International trade finance to boom in Asia in 5 years

Banks will have to intensify their transaction banking platforms as Asian businesses do more cross-border trade, says HSBC's Noel Quinn.

Asian banks brace for a tenfold surge in regional trade flows

HSBC's Noel Quinn says lacklustre trade between Asia and partners in Europe and US may cause capital flows in Asia to increase ten fold - but by when?

How will the EU crisis affect Asian banks in 2012?

Macquarie Securities' Ismael Pili and HSBC’s Noel Quinn reveal their outlook for the Asian market in 2012.

Asia’s business bankers concerned about liquidity shocks from EU crisis

Find out what Asia’s heads of business banking including HSBC’s Noel Quinn, UOB’s Eric Tham and Macquarie Securities' Ismael Pili have to say about the EU crisis and Asia’s banks.

Asian Banking & Finance Retail Banking Awards 2011 winners announced

The region's best banks were recognised at this year's awards held in Singapore. More than 150 bankers from around Asia were on hand to cheer on the winners at Asia's most prestigious retail banking awards.

Singapore Banks may have to make less risky loans to meet new capital requirements

But analysts breathe a sigh of relief that new capital levels not too tight.

Advertise

Advertise