Financial Technology

How Singapore fintech Cashwagon serves Asia's underbanked

In July, Cashwagon launched a cash pick-up option in the Philippines.

How Singapore fintech Cashwagon serves Asia's underbanked

In July, Cashwagon launched a cash pick-up option in the Philippines.

P2P money transfers take off in underbanked Myanmar

Market leader Wave Money has amassed around 7 million subscribers.

Singapore fintech funding nearly quadrupled to US$453m in first six months of 2019

The number of deals surged 55% to 48.

Chart of the Week: Korea's internet-only banks still sparring for market share

The two players only account for 0.6% of the loan market in Q1.

Why you shouldn't miss the ABF Digital & Open Banking Conference

Top executives from Standard Chartered, Revolut and EY will attend the prestigious event.

UnionBank's UBX Philippines ties up with Ping An to build blockchain-enabled platform for MSMEs

It will cover various services such as multi-channel loan applications, credit assessment, and loan disbursements.

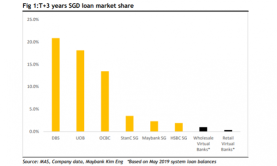

Virtual banks may only account for less than 1% of Singapore loan market by 2022

Retail upstarts may account for 0.3% market share and wholesale challengers will take 0.9% of the market.

How GoBear makes financial comparison easy for the everyday consumer

Its platform matches users with financial products like insurance, credit cards, and trade finance.

Singapore's fintech invasion has no end in sight

About 43% of fintechs in Southeast Asia choose Singapore as their home amidst strengthening growth prospects.

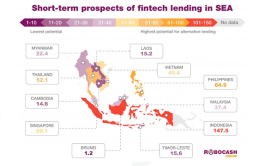

Here's where alternative lending thrives in Asia

The land of GoPay and OVO is no man’s land for banks.

Korea rejects two web-only bank applicants

It cited lack of innovation and concerns over governance and financing.

Crowdfunding flourishes in Malaysia as banks reject loan applications

Equity crowdfunding and P2P platforms have raised $84m for small businesses so far.

Citi Ventures to offer experiential learning in fintech to Singapore students

The 15-week programme at SMU will launch in January 2020.

JP Morgan Invests in Indian fintech startup

Global PayEx offers a cloud-based platform that facilitates electronic invoice sharing.

Citi enables real-time consumer-to-business collections for Vietnamese corporate clients

The bank has tied up with fintech Payoo.

Singapore mulls licenses for virtual banks

The DBS CEO earlier echoed a similar stance.

P2P lender Blend PH targets nearly $20m portfolio by 2021 in financial inclusion push

The platform has attracted millennials, housewives, and overseas workers that have been investing as low as $96 at 8-30% per annum.

Advertise

Advertise