Lending & Credit

Thailand’s TMB Thanachart Bank to see higher profits in Q3

Net profit is expected to come at around $117.5m, 14% higher than a year ago.

Thailand’s TMB Thanachart Bank to see higher profits in Q3

Net profit is expected to come at around $117.5m, 14% higher than a year ago.

CIMB Philippines triples revenue, doubles loan portfolio in H1

The digital-only bank now has 7.13 million customers in total.

HSBC earmarks $1b to support climate tech start-ups

They hope to fund start-ups offering a range of climate tech solutions.

SCB, SMBC act as lead arrangers, coordinators for €500m green loan

The Thai company plans to use proceeds for refinancing purposes.

Weekly Global News Wrap: Morgan Stanley rolling out gen AI support for FAs; Russia’s Sovcombank sues HSBC to recover debt

And private equity firms allege fraud as they seek $750m from Morgan Stanely.

Standard Chartered launches sustainable trade loan

The loan will be available for select eligible activities, such as installation of wind turbines.

MUFG closes $404m green loans to build two data centres in Jakarta

This is MUFG’s second project financed greenfield data centre transaction in APAC in 2023.

Korean banks’ lending to corporates, SMEs rise in August

Loans extended to large corporations and SMEs both rose during the month.

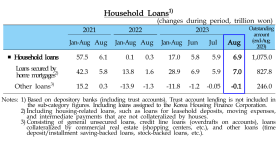

Mortgages drive demand for South Korean household loans in August

Demand for other loan types fell, however.

CIMB raises sustainable finance target to $13.7b by 2024

The bank has already directed close to $9.6b in sustainable finance since 2021.

Chinese banks cut deposit rates: report

The banks cut deposit rates between 5 and 25 basis points.

Weekly Global News Wrap: US floats stricter regional bank rules; Some China banks to cut mortgage rates

And Wells Fargo has agreed to return $40m in overcharged fees to 11,000 customers.

Japanese banks report lower average lending rates in July

City banks’ interest rates for short-term and long-term loans decreased.

Thai banks see improved profits, lower bad loans in Q2

It also laid out plans aiming to reduce household debt.

Standard Chartered sells aviation leasing finance business for $700m

AviLease will also fund the repayment of US$2.9b of net intra-group financing.

China state-owned banks to post ‘sharp’ revenue decline: report

Banks are battling lower lending rates, ongoing property woes, and low interest margin.

Jeonbuk Bank profits to weaken from real estate lending woes

Asset quality and profitability will weaken through 2024, Moody’s said.

Advertise

Advertise