India

Chart of the Week: Lockdown easing drives card payments recovery in India

Fear of COVID-19 spread is driving consumers towards digital payment tools.

Chart of the Week: Lockdown easing drives card payments recovery in India

Fear of COVID-19 spread is driving consumers towards digital payment tools.

India mulls reducing number of state-owned banks to five

The first part would entail the sell-off of majority stakes in six lenders.

Indian banks raise capital against trying times

Top private banks should be able to boost capital effortlessly.

Falling borrowing costs won't save India's embattled shadow lenders

Worries mount of rising bad debts as the pandemic crisis leaves millions jobless.

Rapyd partners with local payment players to launch service in India

It has partnered with local players to allow merchants to access 900 locally-preferred payment methods.

India's Yes Bank slashes public offering share price by 55%

It is the latest Indian lender to raise capital to boost buffers against bad loans.

HDFC Bank extends instant auto loan to Tier 2, 3 Indian cities

It will be available to clients with pre-approved offers.

Indian banks seizing bonds in hopes of government support

A support for the bond market is vital for India's record borrowing plan.

Pandemic may set back Indian banking sector's recovery for years

Nonperforming loans are expected to hit 13-14% of total loans for FY2020-21.

Personal loans, NBFCs anchor surge in Indian outstanding bank credit

Both segments comprised 73% of incremental credit in April.

Indian credit demand surges but recovery still far ahead

Gross non-performing loans drove the increase in credit.

India may inject almost $20b into state-owned banks

A final decision could be made in H2 of India’s fiscal year.

Indian banks want government to fund ‘bad bank'

They are pitching for an asset reconstruction company to buy NPLs.

Impact of COVID-19 on Indian Banks in the Near-Term

The COVID crisis has resulted in an unprecedented disruption to the economic activity, and will lead to major changes in operations of most industries, including banks. Given below are some views on how banks will need to adjust to the new reality once situation stabilises and economic activity starts resuming normal operations. While this note has been made keeping India in mind, most conclusions will be valid for other emerging economies as well.

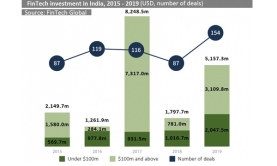

Chart of the Week: India's fintech investments grew 19.1% in 2015-2019

In 2019, local firms raised $5.1b in total from 154 deals.

India directs banks to operate during lockdown

This is to ensure that the government’s relief package reaches the poor.

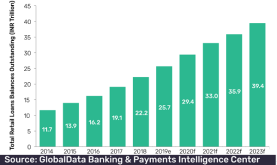

Chart of the Week: India's retail loans will reach $566.7b in 2023

It reached a 17% CAGR to $319.1b in 2018.

Advertise

Advertise