Malaysia

Malaysian banks' deposits up 4.2% in December

Guess which bank had the heftiest increase of 16%.

Malaysian banks' deposits up 4.2% in December

Guess which bank had the heftiest increase of 16%.

Loan-to-deposit ratios up for all Malaysian banks but one in 4Q16

Average LDR for banks jumped to 93.5%.

Bank loan applications in Malaysia drop for the seventh consecutive month

Loan approvals also contracted 5.1% in January 2017.

Malaysian banks' total deposits up 3.1% in January

CASA expanded at a faster rate of 5.8%.

RHB allows customers to open accounts online

Find out more about the RHB Smart Account and RHB Smart Account-i.

Hong Leong Bank's profit up 16% to US$123m in 2QFY17

Thanks to a 2% pickup in loan growth and ongoing NIM expansion.

RHB's net profit down 28% yoy to US$58m in 4Q16

It took FY16 core earnings to US$420m.

Maybank's net profit up 43% to US$530m in Q4FY16

Earnings were lifted by a one-off sale of securities undertaken during the period.

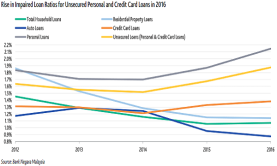

Chart of the Week: Check out Malaysian banks' impaired loan ratio for unsecured loans

It stood at 1.9% at end-2016.

Which Malaysian bank will benefit the most from slowing household loan growth?

Total outstanding household loans grew at a slower rate of 5% in 2016.

Malaysian banks' deposits growth slowed to 2% in December

Business deposits contracted 2.3%.

Malaysian banks' loan growth up 5.3% in 2016

Household and non-household loans also expanded at a similar rate of 5.3%.

Public Bank reports 7.5% loan growth in 2016

Domestic loan growth was at 7.2%.

3 implications on banks' financials when MFRS 9 takes effect in 2018

One is that there will be a one-off provision charge to retained earnings.

CIMB's loan growth target of 6% for 2016 still within reach: analysts

Thanks to a possible pick-up in domestic corporate lending in 4Q16.

How will the MFRS 9 affect Malaysian banks' capital ratios?

Banks' provisioning could increase by as much as 75%.

Public Bank launches new lifestyle debit card for frequent travellers

The bank partnered with UnionPay International.

Advertise

Advertise