Markets

Taiwanese banks' impaired loans may rise 2.5%

Weaker profitability will inhibit capital momentum.

Taiwanese banks' impaired loans may rise 2.5%

Weaker profitability will inhibit capital momentum.

Liquidity to buoy rising momentum of Chinese banks: analysts

The economy has rebounded but demand roadblocks are still present.

Thai central bank not dismissing further monetary easing

It has already cut the interest rate thrice to 0.5%.

Weekly Global News Wrap: Britain, EU must settle financial market access; HSBC to slash 255 jobs in France

And embattled payments firm Wirecard attracts potential buyers.

COVID-19 exposes pitfalls in Indonesia's finance sector

NBFIs have been the main source of problematic defaults.

Strong industrial sector brings robust capital to Taiwanese banks

Current lower-for-longer interest rates will support fragile profits.

China exposes 38 errant shareholders of financial institutions

Such disclosures would be a regular fixture, the regulator said.

Number of fake South Korean banknotes down 19.4% in H1

The number of fake 50,000 won bills only came at 11, from 35 last year.

Indian banks seizing bonds in hopes of government support

A support for the bond market is vital for India's record borrowing plan.

Indonesia mulls returning banking regulation to central bank

The president is reportedly unhappy about the Financial Services Authority's performance.

Japan's regional banks gain lifeline with regulator's strategy switch

The Financial Services Agency has let go of its bank inspection manual.

Japan's second-biggest bank pushes through with overseas expansion

The move contrasts the downsizing planned by other global firms HSBC and Deutsche.

Singapore sets out expectations for FIs' environmental risk management

FIs are expected to include environmental considerations in their business plans.

Philippine central bank slashes policy rate again by 50bp

It has already reduced the rate by a total of 125bp.

China's shadow banking assets grew for the first time in 2.5 years

It makes up 60.3% of nominal GDP as of Q1.

High delinquencies on the horizon for South Korea's financial market: report

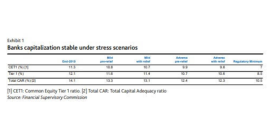

Although the market is now stable, more problems are expected, local regulator says.

South Korean financial institutions spent US$935m in social contributions in 2019

Microcredit lending comprised the lion’s share of US$461m.

Advertise

Advertise