6 months ago

Photo by Minghong via Wikimedia Commons. Apart from cropping the photo, no other edits were made. License: https://creativecommons.org/licenses/by-sa/4.0/deed.en

Photo by Minghong via Wikimedia Commons. Apart from cropping the photo, no other edits were made. License: https://creativecommons.org/licenses/by-sa/4.0/deed.en

HKMA rules out new virtual banking licenses

Competition is keen in the market and enquiries have declined.Competition is keen in the market and enquiries have declined.

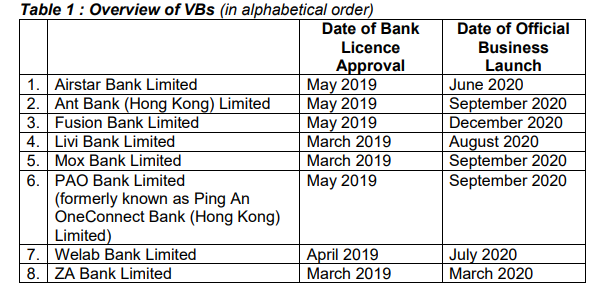

The Hong Kong Monetary Authority (HKMA) said that it does not see strong justification to introduce more virtual bank (VB) players in the market, the central bank said in its 2024 review of virtual banks.

Authorities particularly noted “keen competition” in the city; the fact that the eight virtual banks in the city have yet to achieve profitability; and the decline in enquiries to apply for a license.

“Looking ahead, with the diversity of VBs and incumbent banks, the HKMA considers that the current number of virtual banking licenses is optimal and does not see any strong justification to introduce more new VB players to the market at this juncture,” said Eddie Yue, chief executive of the HKMA, commenting

Introducing more VBs may further intensify competition in the retail banking sector and is “unlikely to be conducive to a healthy development of the sector,” the HKMA added.

Hong Kong’s central bank also noted a decline in the number of enquiries from interested parties to apply for a VB license, which it said indicates a lack of interest from prospective new players in the sector.

Authorities instead intend to maintain the current structure of the VB sector with a view of “facilitating long-term development of the eight VBs” as well as maintaining a healthy competitive landscape in Hong Kong’s banking industry.

Despite the profitability woes and challenges due to the pandemic, the VBs has so far achieved HKMA’s three policy objectives.

“Virtual banking, the innovative banking model driven by the adoption of technology, is gaining wide market acceptance in Hong Kong. The products and services offered by the eight VBs have also received positive response,” the HKMA said.

The eight VBs have 2.2 million depositors as of end-2023.

Advertise

Advertise