Malaysia

Malaysian banks' earnings rose 7% in Q4

Lumpy recoveries of Maybank, AmBank, and Hong Leong Bank boosted the sector’s earnings.

Malaysian banks' earnings rose 7% in Q4

Lumpy recoveries of Maybank, AmBank, and Hong Leong Bank boosted the sector’s earnings.

RHB Indochina offers cashless payment service in Cambodia

It has tied up with mobile payment app Pi Pay.

RHB unveils commercial card line for SMEs and corporates

The RHB Purchasing Charge Card-i is a Shariah compliant charge card.

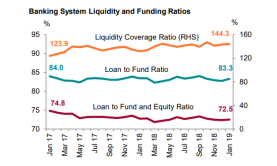

Malaysian banks remain flush with liquidity in January

Liquidity coverage ratio stood at 144.3% which is above the required 100%.

RHB's net profit climbed 18.2% to $570m in 2018

Earnings were boosted by net fund based income which hit $1.2b. RHB Bank Berhad enjoyed a better year in 2018 as net profit rose 18.2% YoY to $570m (MYR2.31b), an announcement revealed. The firm attributed the better net profits to increase in net fund based income which grew 8.5% YoY to $1.21b (MYR4.94b). Moreover, the growth in non-fund based income by 1.8% to $460m (MYR1.86b) contributed largely by higher net foreign exchange gain and trading and investment income. RHB saw its gross fund based income inch up 7.8% in 2018 on the back of a 5.5% increase in gross loans and financing, whilst funding and interest expense rose 7.3% YoY. The firm also recorded a higher NIM of 2.24% in 2018 from 2.18% in 2017 thanks to loan growth and continued prudence in the management of funding cost. The firm’s retail banking business saw a 4.4% increase in pre-tax profit to $250m (MYR1.2b) amidst higher net fund based income and non-fund based income. As of end December, the bank’s retail loans and financing rose 11.1% to $20.77b (MYR84.6b) buoyed by growth in mortgages (14%) and personal financing. Meanwhile, Group Business Banking saw a marginal increase of 1.3% YoY increase in pre-tax profit to $97.63m (MYR397.7m) on the back of higher net fund based income. Gross loans and financing expanded 5.7% to $6.21b (MYR25.3b) driven primarily by Retail SME portfolio. RHB’s Group Wholesale Banking recorded a pre-tax profit of $440m (MYR1.8b), an increase of 2.7% from 2017. Its. However, gross loans and financing slipped 3.8% YoY to $10.70b (MYR43.6b) dragged by several large corporate repayments. The firm’s Singapore unit rebounded from a pre-tax loss of $102.3m to a pre-tax profit of $42m thanks to lower expected credit losses as substantial allowances were provided for corporate bonds and loans in the oil and gas industry in the previous financial year. Moreover, Singapore loans and advances rose 3.3% to $960m (S$3.9b) whilst customer deposits declined 11.7 YoY% to $1.08b (S$4.4b). For the bank’s Islamic business, pre-tax profit climbed 20.7% YoY to $142.19m (MYR579.2m) amidst higher net fund based and non-fund based income. Gross financing jumped 21.6% YoY to $12.84b (MYR52.3b).

Malaysia's Public Bank profit down 5.3% to $345.31m in Q4

Earnings were hit by sluggish loan growth and a decline in asset management income.

OCBC Bank launches token feature on their app

The rollout started in Singapore last month.

Malaysian bank loan growth drops further to 5.6% in December

Working capital, construction, home and auto loans weakened.

1MDB scandal fails to shake trust in Malaysian banks: survey

Banking is still the most trustworthy profession for Malaysians.

CIMB offers reimbursement scheme for foreign remittance

CIMB Preferred customers can get up to $24.31 per day.

Malaysian bank mergers unlikely to take place in 2019

Lenders still have to work on improving ROEs first.

Malaysian banks hike salaries by up to 12% for 20,000 employees

Banks also have to grant 0% interest for the first $24,414 in staff housing loan.

Looming loan slowdown threatens Malaysian banks' 2019 earnings

Lending is tipped to moderate to 5.1% in 2019 from 5.6% in 2018.

Maybank profits down 3.5% to $471.31m in Q3

It was hit by the profit decline in the insurance division over higher contract liabilities.

Hong Leong Bank profits dip 0.6% to $154.75m in Q1

Net interest income declined 5.7%.

RHB Bank profit up 18.4% to $138.84m in Q3

Net interest income rose 5%.

Malaysian bank loan growth up 5.7% in September

Lumpy business loans drove lending gains.

Advertise

Advertise