Malaysia

Chart of the Week: Malaysian banks CASA growth slower than total deposits in July

Total systems deposits growth picked up by 5.8% in July.

Chart of the Week: Malaysian banks CASA growth slower than total deposits in July

Total systems deposits growth picked up by 5.8% in July.

Car loans rev up Malaysian bank lending to 5.3% in July

Consumers took advantage of the GST-free period to buy cars.

Hong Leong Bank profit surged 33.3% to $156.25m in Q4

Lower provisions and strong cost management boosted earnings.

RHB Bank profit up 16% to $281.83m in H1

Half-year earnings were boosted by net fund based and non-fund based income.

Maybank profit up 18.1% to $474.97m in Q2

Lower impairments and expenses boosted quarterly earnings.

RHB Bank to roll out digital loan application platform

It has tapped on fintech iMoney and credit information bureau RAMCI.

Hong Leong Bank enables merchants to accept WeChat Pay

HLB customers can now bind their debit cards into the Chinese e-wallet system.

AMBank profit up 5.9% to $84.93m in Q1

Expenses fell 7% to $125.19m amidst the bank’s efficiency programme.

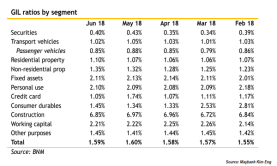

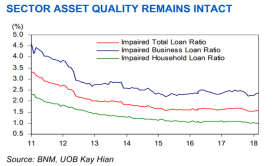

Chart of the Week: Malaysian banks bad loans down to 1.59% in June

Banks shed bad loans in construction and working capital.

Malaysia Public Bank profit up 4.8% to $341.84m in Q2

Its Islamic banking unit performed strongly.

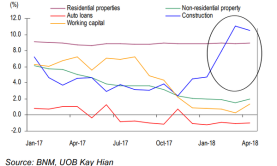

Malaysian banks loan growth remains dismal at 5% in June

Working capital loans failed to recover fast enough.

Chart of the Week: Will the HSR cancellation dampen Malaysian banks' loan growth?

The downturn may even offset the strong performance of household loans.

Here's why the abolition of good and services tax is positive for Malaysian banks

The move might offset pressure on construction loans following the cancellation of the High Speed Rail last May.

MUFG Bank (Malaysia) Berhad appoints Goh Kiat Seng as executive vice president and co-head of global corporate banking in Malaysia

Goh joined the bank on 12 July from Standard Chartered Bank Malaysia.

Chart of the Week: Malaysian banks' bad loans down to 1.6% in May

Consumer gross impaired loan ratio has plunged to a historical low of 1%.

Malaysian bank lending posts dismal growth at 4.9% in May

Working capital loans remained weak.

Malaysian banks waive fees for interbank fund transfers

The move aims to accelerate the country’s cashless transition.

Advertise

Advertise